Stock split formula

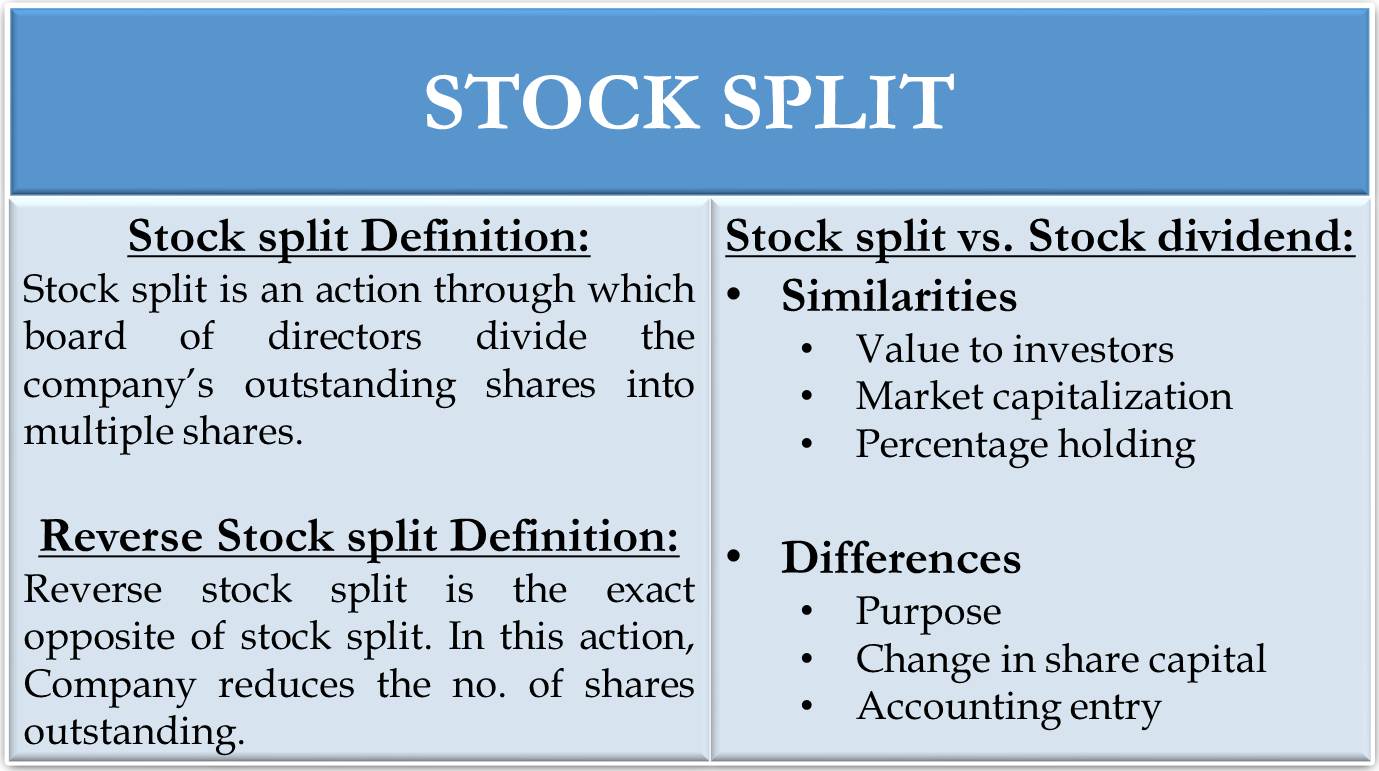

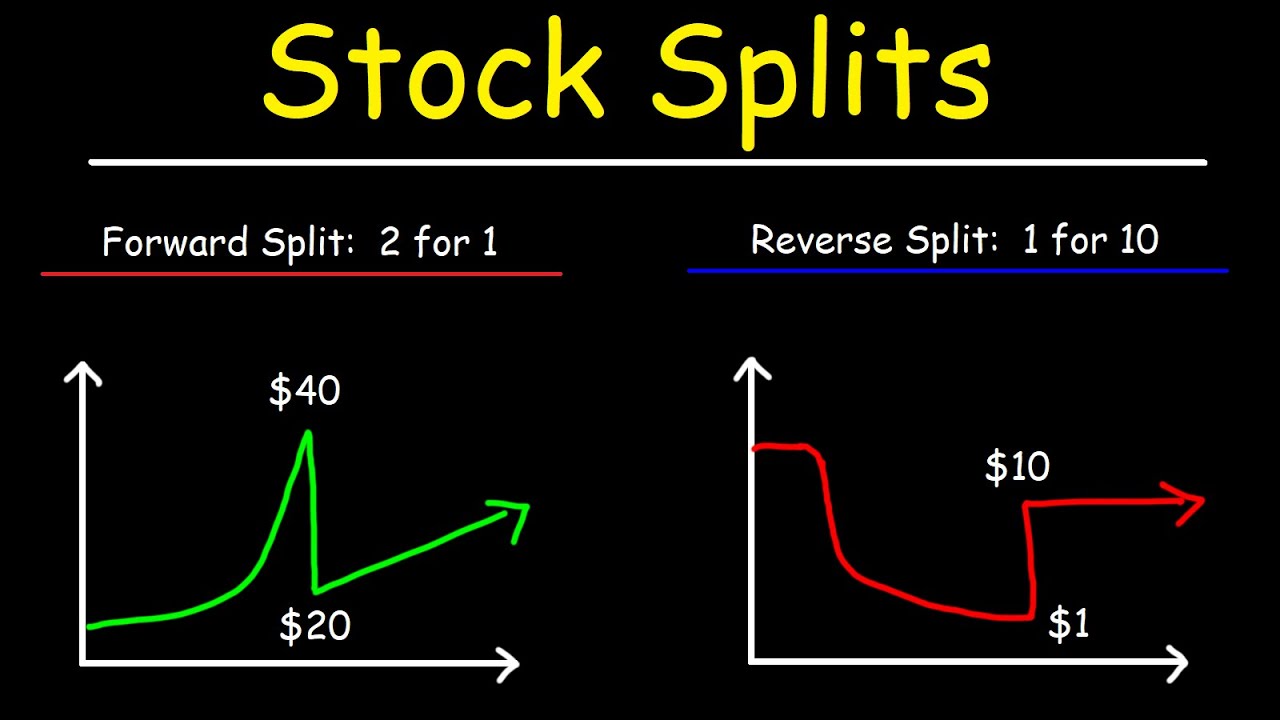

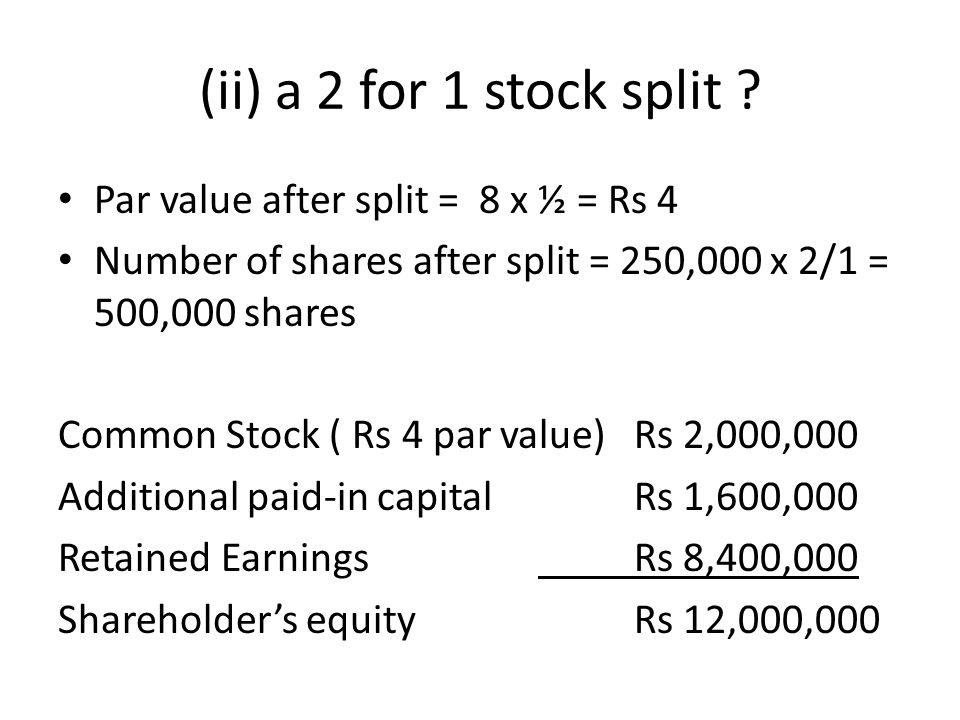

A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. An easy way to determine the new stock price is to divide the previous stock price by the split ratio.

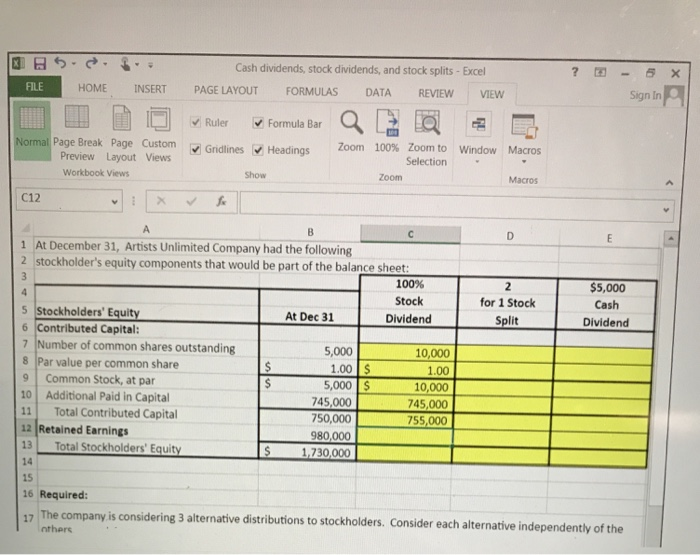

Solved Cash Dividends Stock Dividends And Stock Splits Chegg Com

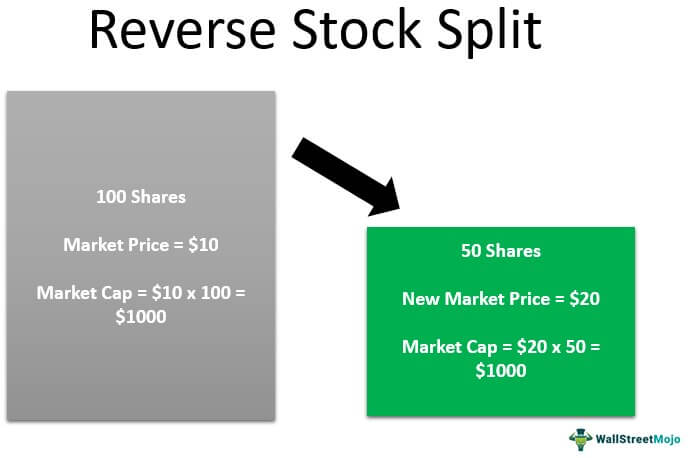

A reverse stock split involves the company.

. Suppose a companys shares are currently trading at 150 per share and youre an existing shareholder with 100 shares. The most common stock splits are 2-for-1 3-for-2 and 3-for-1. If we multiply the share price by the.

A reverse stock split is a corporate action in which a company reduces the total number of its outstanding shares. Thus when a companys share value has risen considerably most public companies will end up declaring an investment break up at some stage to reduce the. A common stock split formula is issuing two shares for.

To calculate the share price post stock split you can apply this simple formula. Stock split sometimes referred to as forward stock split is a practice of increasing the total number of shares of common stock outstanding and making a proportional. The shares were worth 49923 each before the split and post-split it was reduced to 127.

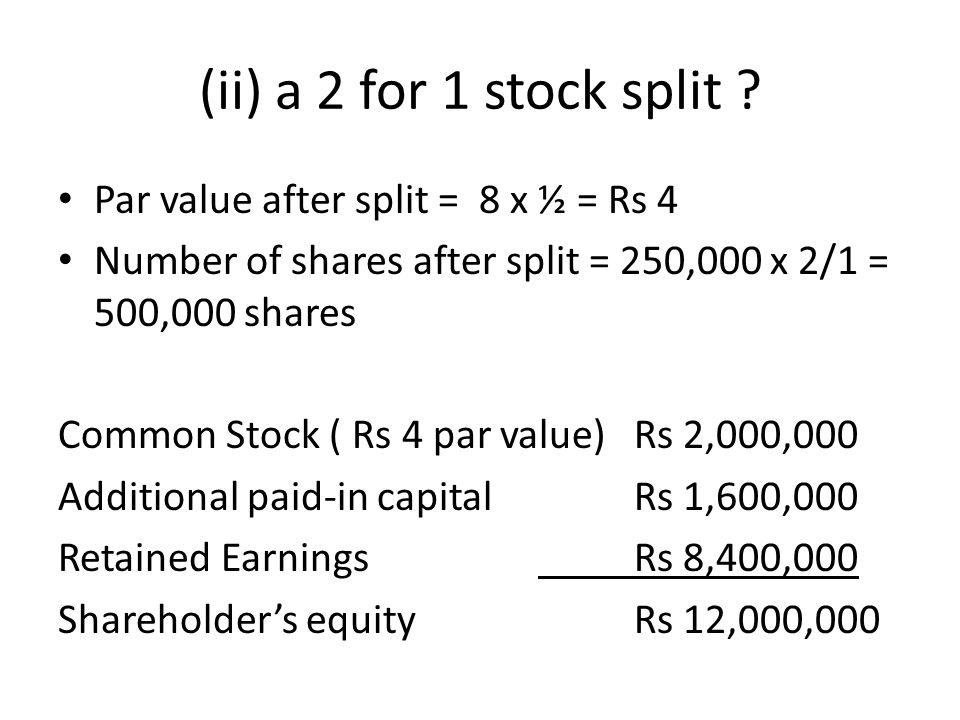

For example a 3-for-1 split would mean a shareholder who owns 1 share in a company. Reverse Stock Split. A reverse stock split happens when a corporations board of directors decides to reduce the outstanding share count by replacing a certain number of them with a smaller.

Forward Stock Split Rules. The math is quite simple but can sometimes end in fraction shares. Although the number of.

The number of shares owned after the reverse stock split can be calculated by the stated ratio of the stock split multiplied by the number of existing. In June 2014 the tech giant split stock as 7-for-1 which reduced post-split price to 93 per share. Stock Split Example Calculation.

A reverse stock split is when a company decreases the number of shares outstanding in the market by canceling the current shares and issuing fewer new shares based. Lets do a quick example. For example in a 2-for-1.

Reverse Stock Split Example Calculation. How to Calculate a 3-for-1 Stock Split Sapling. Corporations choosing forward stock splits increase the number of outstanding shares in the market.

Stock Split Formula. The typical math in a reverse stock split is performed by a companys brokerage firm. A stock split is a decision by a companys board of directors to increase the number of shares outstanding by issuing more shares to current shareholders.

To calculate the number of new shares you will have after a stock split multiply the number of shares you currently own by the number of new. A stock split is when a company divides its existing number of shares into multiple shares. Lets take an example.

New Share Price Old Share PriceStock Split Ratio. Calculating New Shares After Split.

Stock Split Efinancemanagement

Bonus Shares And Stock Split The Concept Formula And Examples Getmoneyrich

Forward Stock Splits Vs Reverse Stock Splits Stock Trading 101 Youtube

Earnings Per Share Eps Meaning Formula Calculations

Bonus Shares And Stock Split The Concept Formula And Examples Getmoneyrich

What Is Stock Split And Stock Split Reverse Formula Hindi Youtube

Price Weighted Index Formula Examples How To Calculate

Reverse Stock Split Meaning Example How It Works

The Effect Of Stock Splits On Adjusted Cost Base Adjusted Cost Base Ca Blog

Stock Split Formula And Google Example Calculator Excel Template

Stock Splits Financial Edge

Bonus Shares And Stock Split The Concept Formula And Examples Getmoneyrich

Bonus Shares And Stock Split The Concept Formula And Examples Getmoneyrich

Dividend Decision And Stock Repurchase Dividend And Split Ppt Video Online Download

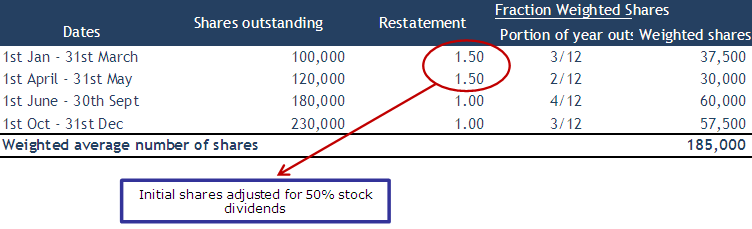

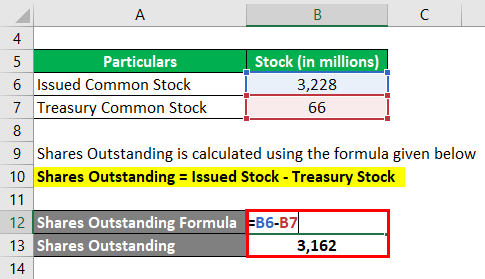

Shares Outstanding Formula Calculator Examples With Excel Template

Stock Split Formula And Google Example Calculator Excel Template

Stock Splits Financial Edge